ProfitBinary Trading Alerts for 5-25-2012

BUYS: 12 Alerts - 4 40 pt alerts

SELLS: 2 Alerts

View the Trade Alerts after the jump...

NOTE: 40 point alerts are 2 unit trades, 30 point alerts are 1 unit trades.

BUY ALERTS:

SELL ALERTS:

ProfitBinary Trading Alerts for 5-25-2012 BUYS: 12 Alerts - 4 40 pt alerts SELLS: 2 Alerts View the Trade Alerts after the jump... NOTE: 40 point alerts are 2 unit trades, 30 point alerts are 1 unit trades. BUY ALERTS: SELL ALERTS: Day 10 brings me to a short review session. Again, today no real

trades was just working on my basics and focusing in on my

strategy. Early in the morning though I did see a great trade

opportunity. I easily could have taken it but I stuck to my plan

and just watched taking notes. The chart will show a wonderful triple top setup. Market moved

up to start the day then made a strong move back down giving us a

small uptrend. The first top was formed in the middle, actually

broke the high and bounced back down. About 30 minutes it did the

same thing but this time a sell would have gone for even more after

it broke the trend completing the anticipated triple top. Any questions on this setup? ProfitBinary Trading Alerts for 5-24-2012 BUYS: 12 Alerts - 5 40 pt alerts SELLS: 2 Alerts View the Trade Alerts after the jump... NOTE: 40 point alerts are 2 unit trades, 30 point alerts are 1 unit trades. BUY ALERTS: SELL ALERTS: As I have discussed the markets have been quite wild the past

few days. There is a lot of speculation on Europe along with

good/bad news making for some heavy swings. Since the markets have

been wild and I have lost the last couple of days I decided to take

a step back and just watch the market while simulating what I would

do. One great trade that I notice today was a great moving average

pullback as you can see from the chart. Price movied into the

moving averages from a pullback creating a buy signal. The result

would have been large profits. Want to point that this would not have been successful for me a

few days ago. I talked about how I was being to cautious having a

tight stoploss. This trade would have needed a little over 2 point

stop loss which for big money traders can be stressful. Sometimes it is good to just relax and get back to

basics. ProfitBinary Trading Alerts for 5-23-2012 BUYS: 9 Alerts - 1 40 pt alerts SELLS: 1 Alert View the Trade Alerts after the jump... NOTE: 40 point alerts are 2 unit trades, 30 point alerts are 1 unit trades. BUY ALERTS: SELL ALERTS: Tough lesson learned today but the good news is that I feel I am

getting better and hope that you are as well. Ended up having a

losing day, but not a lot. This is what I learned from actually a

great losing day. My trades were all fantastic so what went

wrong? On my trades I have an opening stop loss (an order so that if

something catastrophic were to happen I would not lose everything)

at 2 points below/above my trade. After my trade is filled I am

looking to move my stop closer to my entry so I don't lose, playing

the trade bar by bar. This method is not going to work for what I am trying to

accomplish with trendlines and pullbacks. The chart below is an

excellent example of me losing a great trade because I am to

cautious. As you can see the trend pulled back into the moving average by

zone from the top trendline. I bought it and then kept moving my

stop up with no real reason to do so. Eventually I got stopped out

for a minor loss but then the trade skyrocketed up leaving me

wondering what went wrong. Lesson is to not trade bar to bar but to just trust you are in a

great trade based on your system and to let things work themselves

out. ProfitBinary Trading Alerts for 5-22-2012 BUYS: 12 Alerts - 8 40 pt alerts SELLS: 1 Alert View the Trade Alerts after the jump... NOTE: 40 point alerts are 2 unit trades, 30 point alerts are 1 unit trades. BUY ALERTS: SELL ALERTS: ProfitBinary Trading Alerts for 5-21-2012 BUYS: 16 Alerts - ALL 40 pt alerts SELLS: 1 Alert View the Trade Alerts after the jump... NOTE: 40 point alerts are 2 unit trades, 30 point alerts are 1 unit trades. BUY ALERTS: SELL ALERTS: Not an exciting day at the market today, as it did continue

further down but mostly sideways. Talk of the day is obviously

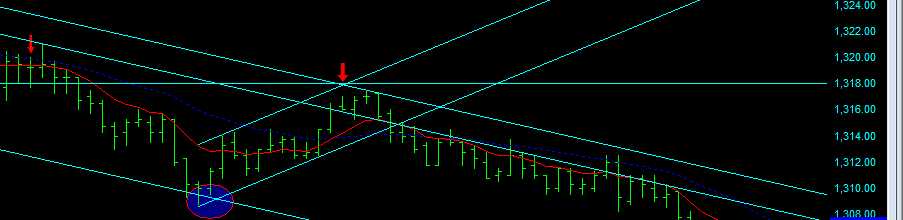

Facebook which we don�t want to concern ourselves with. I want to re-illustrate what I am trying to accomplish with

trendlines. Even in a boring day there are still great trades to be

made. You will notice on the chart we are still using our parallel

downtrend lines from the previous days. The first trade should have

been off of the first red arrow. Your stop would have been just

above the trendline incase it broke out but instead it went way

down to the blue arrow which could have been a buy. I would not

have done the buy at the blue arrow mainly because I was waiting

for it to touch the trendline again. Also, the same thing happened

at the second red arrow for a sell but again my order was at the

trendline so I did not get in. This is the power of trendlines and being patient for the market

to get them. Have a wonderful weekend! Another weird day at the market and it caught up to me today.

Down on trading today but still up for the week with one day to

go. Overall what I learned and what you will see in the chart is

that I really should have been in about 3 trades and instead I was

in way too many which ended up costing me. I also want to note that

all the trendlines were still drawn there from yesterday so I

should have known this going into today. 1. First trade was at the

Red arrow as a sell. This trade should have made the day but I

ended up getting stopped out at the trendline just above it. 2. Should have been in the

first trade until it hit the bottom Trendline at the blue circle.

Which then would have turned into a buy for a nice profit. 3. Lastly should have been

in at the Second Red arrow for a sell off of the top trendline. These three trades would have made for a huge profit and with as

crazy as the market is right now that would have been an

accomplishment. Lesson for today is that I need to be patient and don't freak

out early in the trade. If the trade is valid stay in! ProfitBinary System Alerts for 5/25/12

Shardy's Day Trading Journey - Day 10

ProfitBinary System Alerts for 5/24/12

Shardy's Day Trading Journey - Day 9 - Sitting and Watching

ProfitBinary System Alerts for 5/23/12

Shardy's Day Trading Journey - Day 8

ProfitBinary System Alerts for 5/22/12

ProfitBinary System Alerts for 5/21/12

Shardy's Day Trading Journey - Day 7 - Power of Trend Lines

Shardy's Day Trading Journey - Day 6 - What It Could Have Been

Register For...

Free Trade Alerts

Education

1-on-1 Support

eToro Copytrader Tips