Welcome back from the weekend. In the news Spain is getting

bailed out but uncertainty still looms in Europe creating an

unsteady market. Today I want to discuss three trades that I made

today.

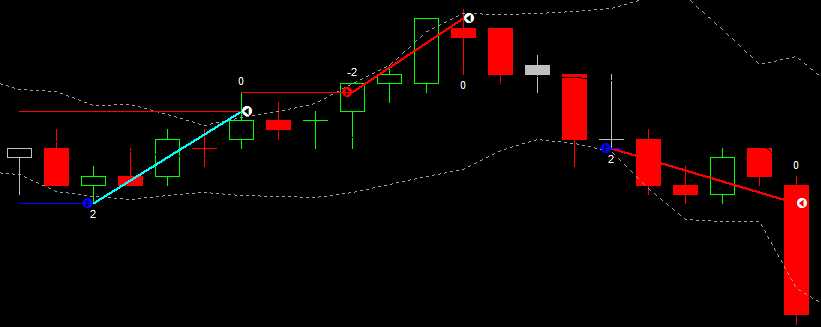

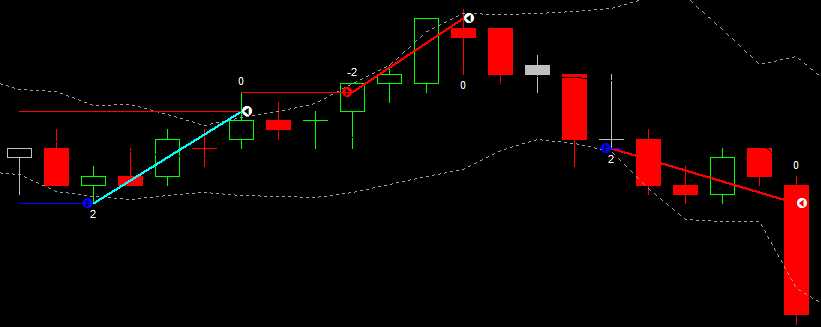

1. First trade was a buy at

the start of the light blue line. You can see that it reached the

bottom part of the Bollinger Band and steadily went up. This trade

was quite profitable. Once it reached the top of the BB(Bolinger

Band) I closed out looking for a good entry to sell.

2. Trade number did not turn

out so well but it was a valid trade so I can't be upset about it.

I exited out of trade one and sold at the top of the BB. You will

see the red line climb up and price hit my stop loss. As I have

said before BB's are not completely accurate and had I gotten in

later it would have been a profitable trade. Sometime it pays to be

patient.

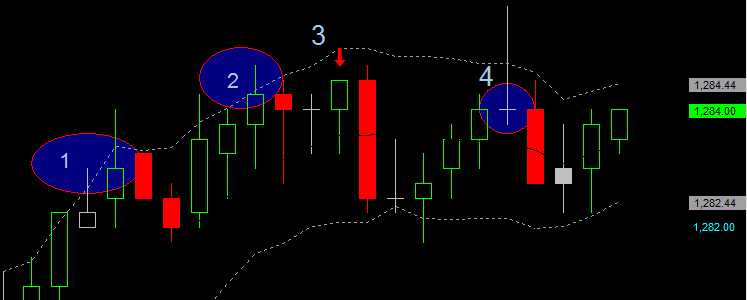

3. Trade three was again a

losing trade but I want to explain how this was still a great trade

by managing risk. Repeating myself again, great traders know how to

manage their losses, that is how they stay profitable! On this

trade I was never really ahead. Realizing that and having every bar

work against me but one I started to manage the trade with my stop

loss. Once there was a green bar I moved my stop to the bottom of

it. This reduces the risk of losing more. Once the next bar formed

which ended up being red I moved my stop to the bottom of it.

Overall, I assured myself minimal loss just in case. It was great

that I did because as you can see shortly after the market dropped

dramatically. Management saved me a lot of money today and actually

kept me profitable on the trade. Had I not managed this trade

effectively I would have had a losing a day.

Hope you are starting to learn how to manage your risk. I am

still in the learning process as well but I keep getting better

each and every day! See everyone tomorrow!

Register For...

Free Trade Alerts

Education

1-on-1 Support

eToro Copytrader Tips