Understanding the Elliot Wave Principle

Understanding the Elliot Wave Principle

Submitted by adil on Wed, 11/26/2014 - 09:27

Tagged as: Forex Trading Online , Forex TradingElliot Wave Principle was introduced by Ralph Nelson Elliot in the early 1930s. He conducted detailed research on the movement of asset price in the market, and found out that the price signals are often repeated. In order to validate his discovery, he made very accurate predictions of the stock market. According to his discovery, the unsystematic signals that seem unrelated, eventually turn out to create an identifiable pattern, once a trader knows what he is looking for. He actually managed to find out the links that triggers the market trends, from politics and culture to the trends in financial markets.

When the Elliot Wave Principle was introduced among the stock traders and investors, mixed reactions were received. Some of them were very excited as they felt that they could finally predict the market trends and place profitable trades according to these trends. However, there were only a few who actually understood the gist of this principle, and took it as a trading tool from which they can learn key trading rules.

When you observe the Elliot Wave pattern closely, you can see that it is built in a structured form just like any other pattern that is formed in the nature. So why is it structured? This is because, the patterns found in nature keeps building on themselves, whether it is botany, geography, or things like roads, colonies, etc. According to the latest findings in a financial world, it is confirmed that even the market price of an asset follows the same pattern. With the passage of time, these patterns grow and their structure is determined by the intrusions in the growth process.

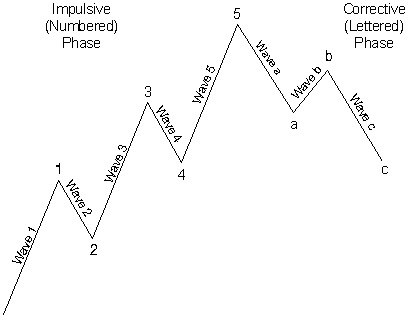

The first phase in the Elliot Wave Principle is to find patterns in the market. There are, in fact, two types of wave patterns, a corrective wave pattern and an impulse wave pattern, and the basis of these patterns are very simple in nature. An impulse wave pattern consists of 5 sub waves, and the movement of these waves is in the same direction as a trend of upcoming higher size (as shown in the figure as 1, 2, 3, 4, and 5). They are known as impulse waves due to their impulsive behavior of impelling the market.

On the other hand, corrective waves have 3 sub waves, and the direction of these waves is opposite to the trend of next upcoming higher size (as shown in the figure as a, b, c). These waves not do completely achieve the retracement of progress attained by the previous impulse waves. If you look at the image below, a complete Elliot wave is composed of 8 waves in 2 phases. The first phase is of 5 impulse waves, and the second one is of corrective waves.

The purpose of Ralph Nelson Elliot was to explain the traders through this principle that how and why a market behaves in a certain way. He further stated the crucial facts of this principle, according to which, every pattern has identifiable “tendencies” and “requirements”, and with the help of these facts, he managed to develop different rules for a proper wave identification. However, a detailed knowledge of this principle is required in order to see what the market is capable of doing, and what it cannot do.

Register For...

Free Trade Alerts

Education

1-on-1 Support

eToro Copytrader Tips