How to Use Three Indicators Strategy with Binary Options

How to Use Three Indicators Strategy with Binary Options

Submitted by adil on Tue, 02/10/2015 - 18:01

Tagged as: Binary Options Trading , Binary OptionsTo get the best trading results, it is imperative to combine various technical tools for analysis. By combining MACD, RSI and MA and using two different time frames, we obtain the three indicators strategy which many professional traders use regularly.

Things required:

Considerable technical analysis skills are required to utilize this strategy. The trader must be able to analyse various information streams at the same time. The trader must have access to a broker service that has no entry delay otherwise there will be no way to control the strike price.

The basics:

This strategy was designed to be used with either daily or four-hourly time frames. Smaller time frames can be used, but it is not recommended with this strategy as it might lead to wrong conclusions. Only apply this strategy if following the main market trend.

If your broker offers any trading tools, you can also utilize them with strategy. The strategy revolves around the basic moving averages which is offered by every broker. The moving average curve will provide the basic idea about the market movement to the trader. The trader will need to reconfirm his initial findings with the MACD and RSI indicators for binary options.

Trading with the strategy:

In this strategy, the closing price indicated by the last candle of the previous day is correlated with the simple moving average to determine either CALL or PUT trades should be entered.

When CALL trade must be entered: Using a four hour time frame chart, if the last candle of the previous day closes above the moving average line, it is best to only trade with binary option CALL buying.

When PUT trade must be entered: Using a four hour time frame chart, if the last candle of the previous day closes below the moving average line, it is best to only trade with binary option PUT buying.

If it is not possible to determine any correlation between the positions of price candle and the moving average line due to any reason, it is better to refrain from trading on that particular trading day.

Using MACD and RSI:

To correctly determine which candle must be correlated with the moving average line, and to be more definite about the overall analysis, the MACD and RSI indicators are used.

When using RSI (Relative Strength Index), the direction (up or down) of its curve must be noted. While using MACD (Moving Average Convergence Divergence) indicator, the direction (top-down or bottom-up) must be noted at the very moment the curve crosses the zero level.

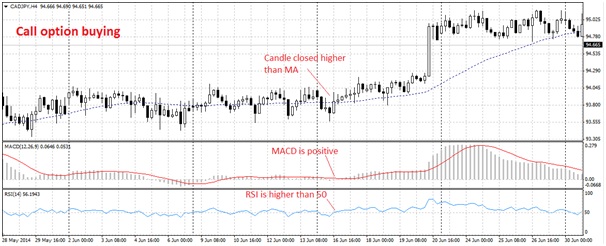

Confirming CALL trade: Using a four hour frame, if the last candle of the previous day has closed above the moving average line, and RSI curve has followed the price upward direction, and MACD curve has crossed the zero level by moving from bottom to up, CALL trade should be made.

Confirming PUT trade: Using a four hour frame, if the last candle of the previous day has closed below the moving average line, and RSI curve has followed the price downward direction, and MACD curve has crossed the zero level by moving from top to down, PUT trade should be made.

A lot of practice is required to master this advanced strategy.

Register For...

Free Trade Alerts

Education

1-on-1 Support

eToro Copytrader Tips