Forex Trading Strategy Based On Pin Bar

Forex Trading Strategy Based On Pin Bar

Submitted by adil on Mon, 06/30/2014 - 20:30

Tagged as: Forex Trading , Forex Trading

Here's a Really Good Forex Pin Bar Strategy!

The pin bar is a combination of a long tail which is usually called a wick, and a small body which is either filled with solid color or is completely hollow. Although this strategy can be deployed with any chart constituting of pin bars, it works best with candlestick charts for reasons that will be explained later. Let us analyze how a trader can take advantage from the pin bar strategy in FOREX trading.

How to trade?

Some occurrences of pin bars indicate an impending reversal in market trend. It will be explained later how a pin bar formation can be used to detect bearish or bullish market trend. To maximize successful trades there are several market entry points available:

- Entry at current market scenario: The trader places the trade call at the instant he thinks the order will be fulfilled at the most appropriate price. If the pin bar depicts a bearish trend, place a selling trade and if the pin bar shows a bullish trend, place a buying trade.

- Entry with a stop order: Placing a stop order at a level you want market entry is required in this strategy. The market price needs to move in the price you selected with the stop order to trigger it. So this trading requires good market knowledge and understanding. Remember that in-case of placing a sell stop, the order price must be lower than the current market price including the spread. Similarly, the order price must be higher than the present market price including the spread in-case of buy order placement.

If the pin bar shows a bullish trend, try to buy on a break of the high of pin bar and set the stop loss 1 pip below the low of the pin bar tail. In a similar fashion, when a bearish trend is indicated, it is advised to sell on a break of the low of pin bar and set the stop loss 1 pip above the high of the pin bar tail.

- Entry with limits: This is one of the few ways to take advantage of the retracements that are common in FOREX trading. Occasionally the pin bars will retrace 50% of their tail, which provides an opportunity to enter the market with a limit order. This is the perfect high risk – high reward situation because of the tight stop loss either just above or below the pin bar high or low.

How to use pin bar formation to detect overall market trend reversals?

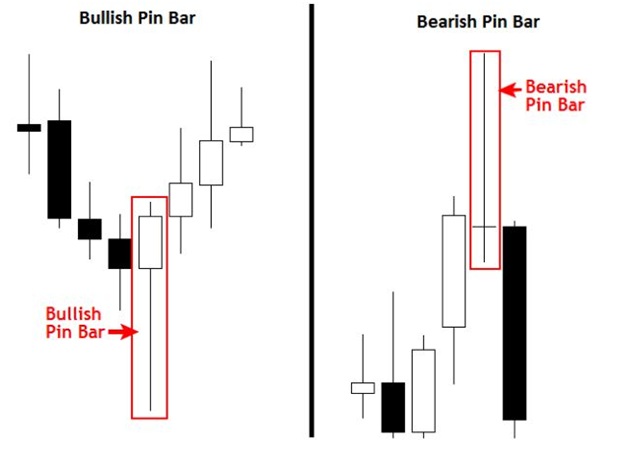

The picture below shows the bearish and bullish reversal pattern.

In a bullish trend reversal, the pin bar’s tail is pointing down which shows a rejection of further drop in prices, and presence of support. Usually this setup leads to rise in prices.

In a bearish trend reversal, the pin bar’s tail is pointing up which shows a rejection of further rise in prices, and presence of resistance. Usually this setup leads to drop in prices.

Why candlestick charts are the best option?

- Candlestick charts can be used very efficiently to detect market trend reversals.

- It is the most popular chart among professional traders.

Register For...

Free Trade Alerts

Education

1-on-1 Support

eToro Copytrader Tips