Is Microsoft set to recover it’s Surface value?

Is Microsoft Set to Recover It’s Surface value?

For a while now, Microsoft, the software giant, has been trying to not only penetrate but gain a significant share of the tablet market and more specifically, the hybrid tablet market which combines a laptop and a tablet.

Thus far, though, Microsoft has had little success. The Surface has pretty much failed not only in taking the lead but even in gaining any significant market share, leaving investors less than optimistic.

However, the big guys at Microsoft are not giving up. Nowadays they are pinning their hopes on a new contender, the Surface Pro 3 which, thanks to its impressive specs, they believe will change the picture and turn things around for Microsoft.

Breaking into the market isn’t easy with heavyweight competition from Apple and Android powered tabs, but Microsoft execs are hoping to establish themselves as the leader in this very specific tablet-hybrid niche with the Surface Pro 3, which is both very attractive and exceptionally functional.

The company is hoping that sales of the Pro 3, which according to execs are at the fastest pace yet, will also help significantly boost revenues of the previous generations which amounted to some $409 million in the 4th quarter of 2013. In fact, Microsoft execs believe that the Surface Pro 3 will soon be the go-to tablet for most users.

Beyond the Surface

So what does this hybrid tablet have that makes it different from its predecessors as well as its rivals? To begin with, the Surface Pro 3 has a 12” screen, and an aspect ratio of 3:2, rather than 16:9. The speakers have also been moved to the front which makes it 45% louder, and at only 9.1mm thickness, it’s noticeably thinner than the other Pros.

Apart from the aesthetics, there’s clearly more than meets the eye to this tablet, including 10% better performance, a docking station and 4K display support. Two things that had users somewhat frustrated in the previous versions of the Pro have been modified: 1) the newly designed kickstand allows the Pro 3 to lie down nearly flat to 150° for ease of writing, especially when using its newly designed and multi-functional pen; and 2) the trackpad has been enlarged and significantly improved to reduce friction.

It’s All about Market Share

So what does this hybrid tablet have that makes it different from its predecessors as well as its rivals? To begin with, the Surface Pro 3 has a 12” screen, and an aspect ratio of 3:2, rather than 16:9. The speakers have also been moved to the front which makes it 45% louder, and at only 9.1mm thickness, it’s noticeably thinner than the other Pros.

Apart from the aesthetics, there’s clearly more than meets the eye to this tablet, including 10% better performance, a docking station and 4K display support. Two things that had users somewhat frustrated in the previous versions of the Pro have been modified: 1) the newly designed kickstand allows the Pro 3 to lie down nearly flat to 150° for ease of writing, especially when using its newly designed and multi-functional pen; and 2) the trackpad has been enlarged and significantly improved to reduce friction.

It’s All about Market Share

So why is Microsoft’s newly issued Surface Pro 3 so important? Why is Microsoft trying so hard to tap into the tablet market? For stock investors, it’s all about the value to shareholders, i.e. the eventual revenues. While Microsoft currently has an annual revenue of above $80 billion, little of this comes from tablets. What Microsoft execs are hoping for is that with the new impressive Surface Pro 3, they could eventually gain a significant share of the pie and for stock investors that would mean more revenues, more profits and a higher share price.

Traders See Value

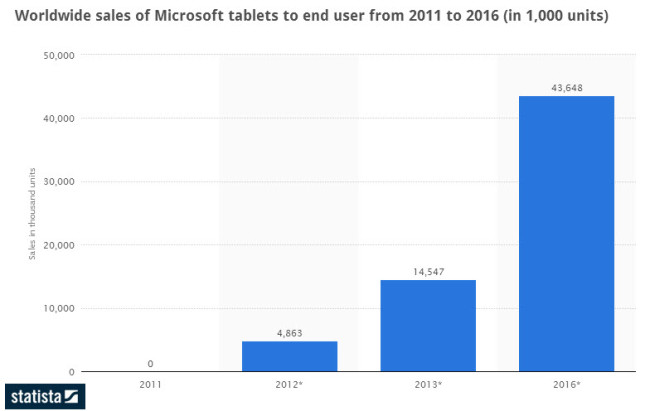

As seen in the chart above which is, to some extent, fed by projections from Microsoft, Surface sales are expected to reach 43 million devices, or three times the number of devices sold today, by 2016. That is rather ambitious on the one hand but on the other, of course, the tablet arena is not the only “game” that Microsoft is playing. In fact, it’s part of a bigger shift initiated by new CEO, Satya Nadella, who is focused on re-establishing Microsoft as a technological rather than business-focused leader.

One the one hand, this chart shows the high expectations from Microsoft, but on the other the risk of big disappointment that could to hit the stock hard. This is why experience in stocks matters and why the ability to identify when to get in and when to get out of the market is critical. And this is where following some traders with a strong ability for returns could prove favorable or, at the very least, something worth pondering.

So which traders are in a position to gain if Microsoft gains? We have located a couple of traders, Yazan Haddan from Jordan and David Venter from South Africa, who have two things in common; they both have good returns and they both invest in Microsoft. So while buying Microsoft now could present a challenge, using the wisdom of these two traders who have both done well this year, with each earning more than 15%, could at least be a tool to consider.

Article Written By: Abby Tsype

Register For...

Free Trade Alerts

Education

1-on-1 Support

eToro Copytrader Tips